Ralph Nelson Elliott developed the Elliott Wave Theory (aka Elliott Wave Principle, Wave Principle, or Wave Theory) in the 1930s. He analysed stock market prices and proposed that no matter how large or small the scale, prices developed with a constant basic pattern or design. These patterns became known as Elliott Waves.

This article is a bit geeky, and a bit mathsy – but don’t worry, you do not need to know it.

I thought it was a good idea to put a bit about Elliott Wave Theory here. If you are going to use a new idea, it’s good to know what’s behind it. That way, you get the confidence it can do what you want it to do.

Some people like to see this stuff, and for you, please read on.

If you’re not one of those people, don’t worry, skip this one!

Social Mood

Elliott Waves applied to the stock market were said to be a reflection of sentiment or the collective human social mood. Elliott’s theory said there was a definite shape to the waves, and they shared characteristics with many patterns found in nature.

Fibonacci Numbers, Golden Ratio

These natural patterns involve Fibonacci numbers and related concepts like the Golden Ratio, Golden Section, Golden Rectangle, Golden Spiral and so on. These have long been observed in the natural world in many forms as representations of progress and growth. Golden Spirals, for example, can be observed in diverse places like bacterial growth rates, pine cones, ferns, animal horns, hurricane clouds and even in spiral galaxy formations in outer space.

So the waves Elliott identified could be a means of describing growth and decay, expansion and contraction, or progress and regress.

Fibonacci Sequence

Using Fibonacci, the simplest expression of progress and regress is a straight-line increase and a straight-line decrease. In that case, the number of movements both up and down is 1, or 2 for the whole sequence.

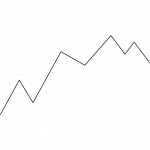

In the next degree of complexity, the number of movements up is 5, down is 3, for a total of 8.

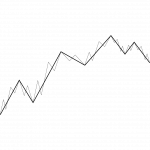

Continuing, next there are 21 up, 13 down, for a total of 34.

As you can see, this sequence is the Fibonacci sequence of numbers: 1,1,2,3,5,8,13,21,34,55,89…

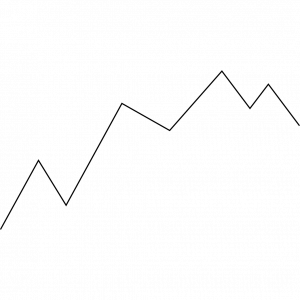

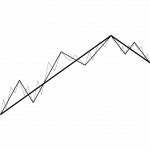

Putting it together, you can see the overall progress and regress, as well as the progress and regress at different levels of scale that make up the overall picture:

Market Growth

Market prices do not move in a straight line. Therefore, they don’t go straight up or straight down. This means there are periods of increase, followed by a pause or decrease before increasing again.

Elliott & Endurance Running

This principle of growth and decay or progress and regress caught my eye for endurance running. Applying these principles, training volumes wouldn’t go up in a straight line. There would be periods of increase, followed by a pause or decrease before increasing again.

Of course, this fits with the widely accepted training principle that difficult training should extend you, followed by gains in rest periods as the body builds and recovers.

A feature of the Wave Theory is it provides specific rules and guidelines. Wave Running has adapted these to create a method of determining training levels and rest periods for training programs, both in volume and time, based on the target you’re trying to achieve.

Therefore a training program can be created by nominating a target volume, a start and end date, and applying the principles and guidelines of the Elliott Wave Theory.

Wave Running Program – MRUM 2020

Here is the actual Wave Running Elliott Wave for the training program I used for the Margaret River Ultra in 2020:

Here you can see the ideal Elliott Wave (the thin line). The thicker line is the fitted wave used to determine weekly training volumes. As you can see, there are periods of increase (heavier training volumes) and periods of rest (lighter training volumes). These periods occur in a non-linear and non-regular way for both time and volume.

The top of wave (1) coincides with the peak training volume. Wave (1) is an impulse wave comprised of 5 waves up (5-3-5-3-5 – the thin line). Wave (2) taper follows, which is a 3-wave correction (5-3-5 – the thin line). The beginning of wave (3) up is the event week – this is the end of the training program.

Using the Elliott Wave Theory, Wave Running can create a training program for different endurance targets. Each program incorporates calculated heavy week volumes, rest week volumes, taper volumes and duration, all at an appropriate level to support your event target with confidence.